In 49 out of the 50 states, it is illegal to not have car insurance, Nebraska included. In a recent survey sent out to Yutan students and staff, however, 69.4 percent know only some or very little about car insurance. That’s over half of the school only having a small idea of what car insurance—something that is required for all drivers—does.

Having the basic knowledge of car insurance is important not only because insurance is required by law but also because one day that knowledge might be needed. One simple part of car insurance that is good to know is car policies’ coverages.

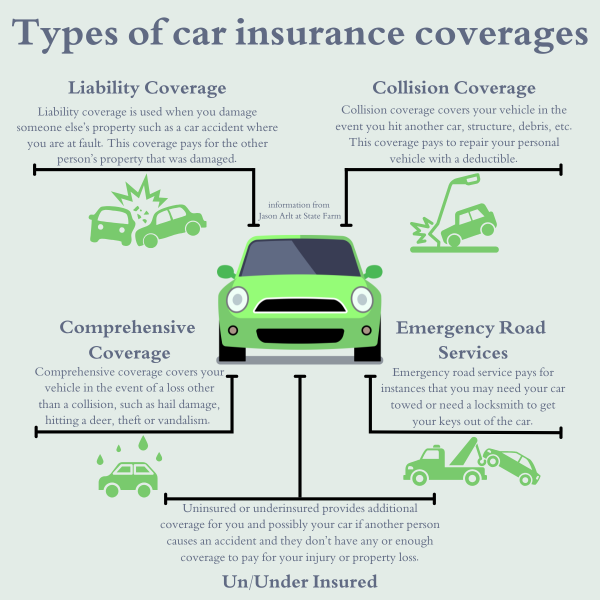

“A car policy has many kinds of coverages. The most commonly used coverages are liability, collision, comprehensive, emergency road service and un/under (uninsured or underinsured) insurance,” State Farm insurance agent Jason Arlt said.

Liability and collision coverage are typical types of coverages someone may use or need when they get into an accident. Although these coverages may seem similar, both play a different role in the case where car insurance would be needed.

“Liability coverage is used when you damage someone else’s property, for example, a car accident in which you are at fault. This coverage pays for the other person’s property that was damaged,” Arlt said. “Collision coverage covers your vehicle in the event you hit another car, structure, debris, etc. This coverage pays to repair your personal vehicle with a deductible.”

Arlt explained that a deductible is an amount the insurer pays before the rest is paid off by the insurance company. The deductible amount affects the overall car insurance rates, which are how much a person pays for insurance.

“With a higher deductible, you have cheaper rates because the person pays more off the cost of the damages. With a lower deductible, there’s higher rates because the insurance company pays more of the cost of the damages,” Arlt said.

Besides the deductible amount, another big factor in a driver’s car insurance rate is how safe that driver is on the road.

“Good driving and low mileage driving can help rates go down. Accidents, tickets and poor driving can make rates go up,” Arlt said.

If a driver finds themselves in a situation where they’ve received a ticket, there are still options that can help prevent the ticket from making insurance rates increase.

“Sometimes, a STOP class is offered to have the tickets removed,“ Arlt said. “A STOP class is for if you get a speeding ticket, the cop could allow you to take a class to get it removed.”

While there is a chance rates won’t go up with a ticket, they will increase when the driver is involved in a car accident.

“Accidents are a huge indicator to insurance companies on the risk of a driver and household. It will likely have a negative impact on rates,” Arlt said.

In the case that a driver does have an accident, the biggest step to do with insurance is file a claim.

“Putting in a claim after an accident gets your car fixed back to what it was. The policy holder chooses a repair shop and most times the insurance company and repair shop communicate to get the payments made and get the car repaired,” Arlt said.

Arlt recommends that drivers understand what their car insurance includes and how they can drive safely.

“Understanding the coverages of your insurance is important so you know what you are paying for,” Arlt said. “Not driving distracted, obeying the traffic laws and being attentive to your surroundings will keep your insurance rates reasonable.”